Automated Reporting Is the Engine. Dynamic Dashboards Are the Upgrade

In every financial institution, reporting is a reflection of operational health, accountability, and trust.

But the reality? Reporting still consumes massive amounts of time, manpower, and budget. Hours that could be spent improving customer experience, strengthening internal operations, or driving strategic outcomes.

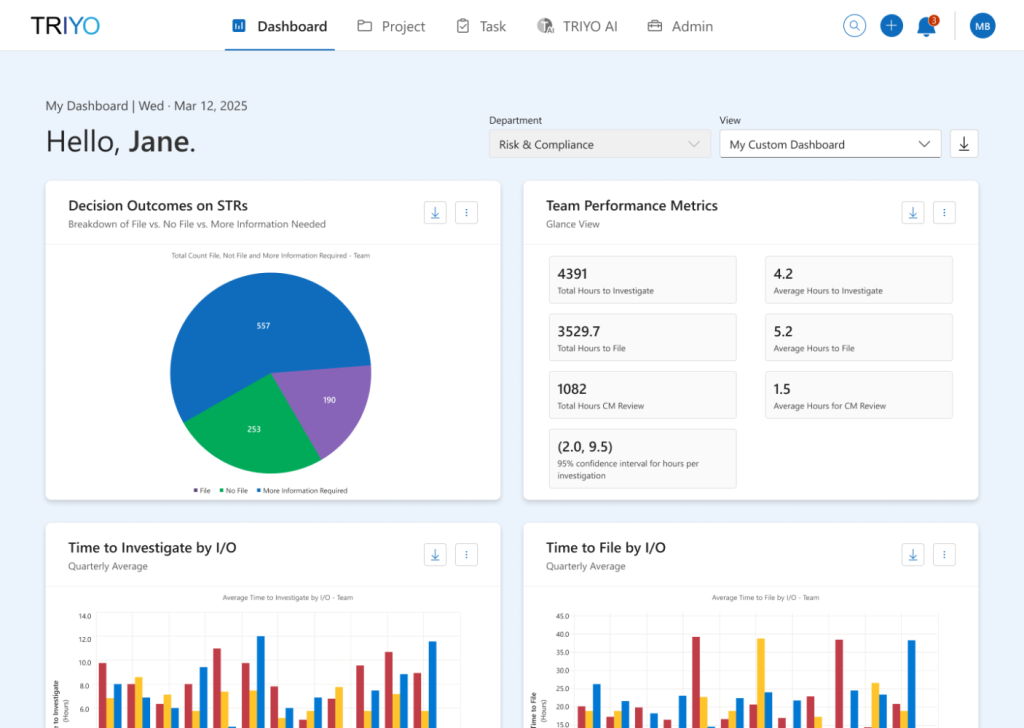

This is why TRIYO focuses on automated reporting and dynamic dashboarding. Automation ensures the data is correct. Dashboards ensure people can see and act on it.

What Dynamic Dashboarding & Automated Reporting Deliver

- Zero-Lift Reporting: Instead of teams digging through documents, emails, and systems, TRIYO captures work data automatically as it happens. No manual compilation, no back-and-forth, no human error.

- Real-Time Dashboards That Update Themselves: When reporting is automated, dashboards become living systems. Every action—every submission, approval, risk score, task change—updates in real time.

- Natural Language Queries That Turn Questions Into Charts: Teams can ask:“Show me STR trends over the last quarter.”“What’s our turnaround time by analyst?”“Which workflows are creating the most delays?”And TRIYO generates the charts instantly and no BI developer is needed.

- AI-Ready Data Foundation: Automated reporting creates structured, contextualized datasets—exactly what institutions need to deploy predictive analytics, anomaly detection, and agentic workflows.

What this means for everyone

With TRIYO, financial institutions of every size—from Tier 1 banks to community credit unions—can finally replace static, manual reporting with real-time visibility that evolves as work happens.

Automated reporting and dynamic dashboards cut down compliance and operational overhead, surface risks earlier, and eliminate the need for constant BI support or expensive system upgrades.

Larger banks get the clarity and speed to manage complexity at scale. Credit unions gain enterprise-level analytics at a fraction of the cost. Everyone gets stronger audit readiness, reduced reporting burden, and more time to focus on members, customers, and strategic work.

TRIYO levels the field and gives every institution the power to operate smarter, faster, and AI-ready.

The Bottom Line

By combining automated reporting with dynamic dashboarding, financial institutions finally unlock the visibility, accuracy, and intelligence they’ve been trying to build for years but without the cost, complexity, or disruption.

It’s the fastest path to operational efficiency today and AI readiness tomorrow.