The threat of a recession has been looming for months. Mass layoffs across firms in the finance and tech industry are the first signs of it unfolding. In January 2023, Goldman Sachs let go of more than 3,000 staff which amounts to about 6.5% of their workforce. Closer to end of January, tech-giant Google also laid off about 12,000 employees. Such large scale lay-offs are hardly a surprise, it is a cyclical occurrence in an economic cycle.

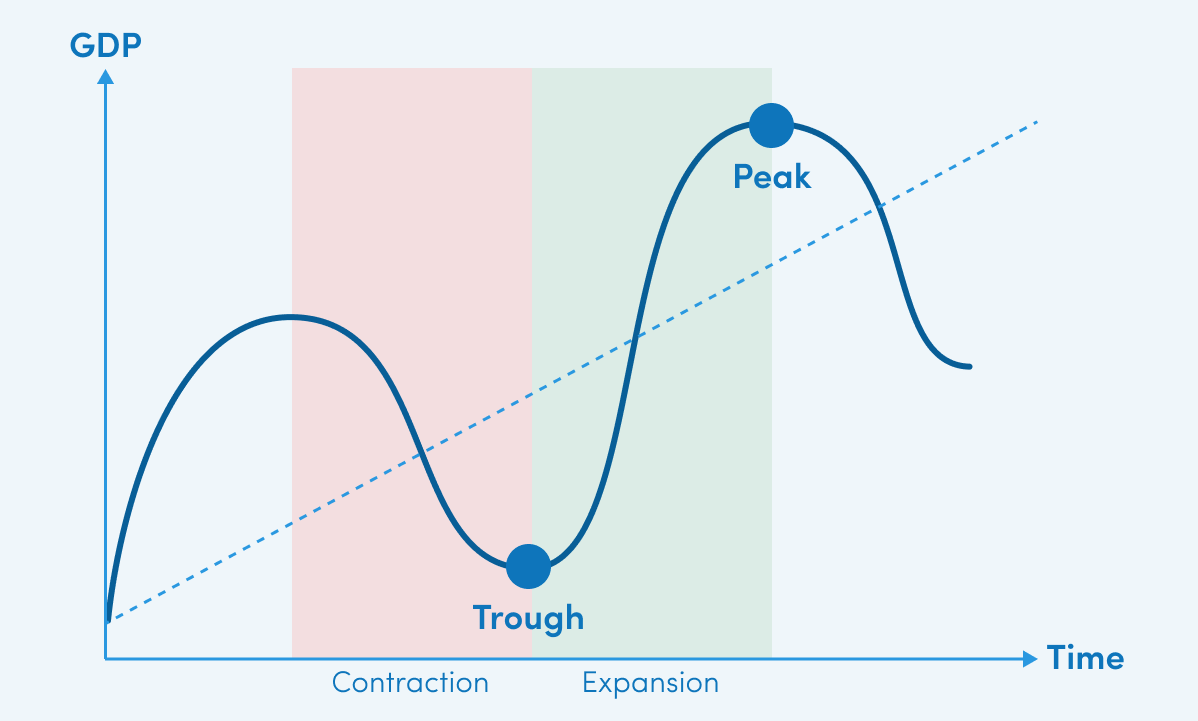

While the effects of the recession are rampant, one must understand what exactly a recession is. According to the National Bureau of Economic Research (NBER), a recession is defined as “a significant decline in economic activity that is spread across the economy and that lasts more than a few months” where a few months is usually 2 quarters. The decline in economic activity is commonly associated with a reduced or negative Gross Domestic Product (GDP), which is the monetary value of the final goods or services bought by a final user produced in the domestic country. Simply put, the economic output of a country has shrunk.

Exhibit 1: Economic Cycle Graph

There are several causes for a recession, the most common ones being economic shocks like the pandemic, inflation and pessimistic economic outlook of investors. The causes of a recession are often intertwined, causing a domino effect once one has been triggered.

Economic shocks are unpredictable events occurring outside of the economic model that have lasting widespread effects on the economy. One of the most recent economic shocks was the Covid-19 pandemic that resulted in worldwide supply chain shortages due to the lack of movement of goods during the lockdown. Imports were now in shortage worldwide. This supply shock triggered high prices for raw materials and commodities, making it expensive for businesses. Since raw materials became more expensive, it translated to higher prices for the final goods and services. This increase in price is also known as inflation.

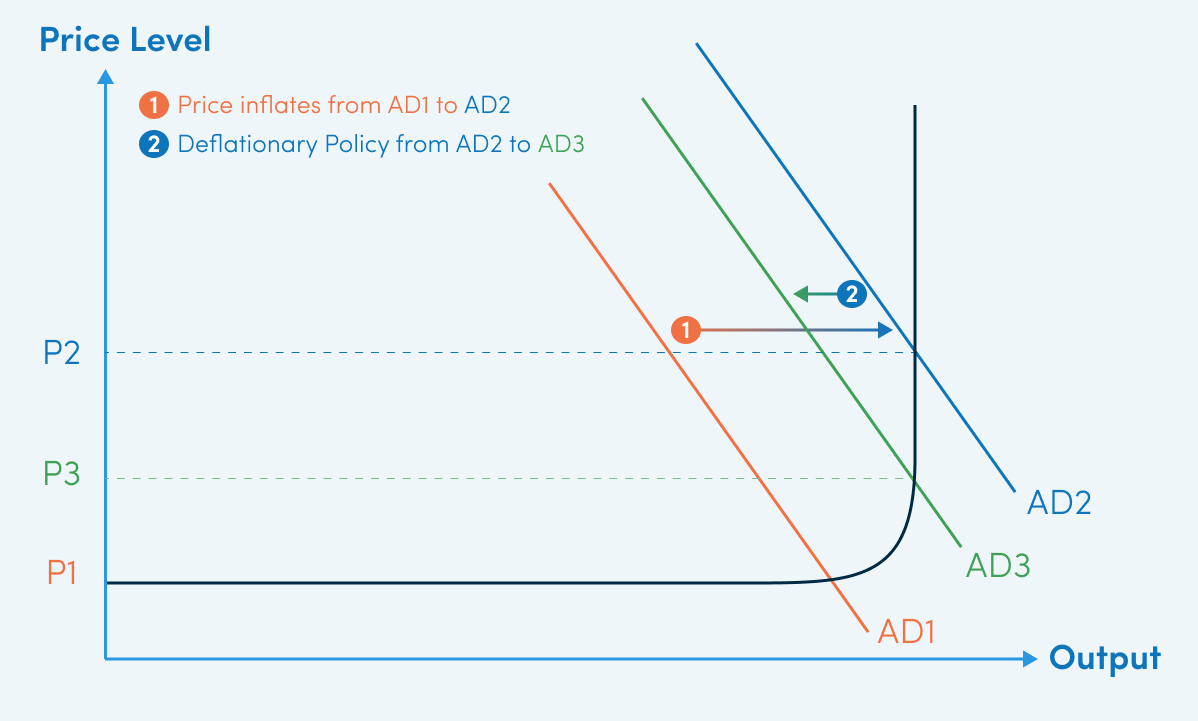

Inflation happens when there is an in increase in the cost of goods and services, eroding the purchasing power of consumers. In order to combat the increase in price, the Central Bank can choose to employ a monetary policy. In other words, they will increase interest rates to increase the cost of borrowing in order to curb consumer spending. Consumers are now disincentivized from borrowing as they would be charged a higher interest for the sum borrowed (in other words, debt becomes even more expensive). Hence, the quantity demanded for goods and services falls at every price, lowering the demand and therefore consumer spending.

Similar to consumer spending, investment volume also falls as it is more expensive to borrow money to finance new projects. Overall, the fall in investment and consumption causes GDP to fall (ceteris paribus, or in other words if all other variables hold constant). Thus, the deflationary monetary policy indirectly causes a reduction in GDP and therefore triggers a recession.

Exhibit 2: AD/AS graph on deflationary policy

When investors react to market shocks with pessimism, the effects of their actions are amplified throughout the market. For example, when investments are withheld during a market crash. While economic outlook is subjective, the reactions are often informed by previous market activity. Investors actions have a ripple effect on the rest of the economy. Thus, a negative economic outlook could be the tipping point of the economy into a recession.

During a recession, companies are likely to reduce expenses and conserve cash. A multi-prong approach is often employed to cut back on expenses. There are some common strategies that are often employed.

One of the fastest ways to reduce expenditure is to reduce employee headcount. The extent of layoffs varies for different companies but is most significant in larger corporations in finance and tech. So how do organizations decide on who to let go? Some companies may utilize the “last in, first out” approach. However, this approach might pose other long-term concerns. Given the tight labor market and competition to acquire talent, companies do not want to let go of employees having just hired them. The company would be scrambling to find individuals to cover the role (if needed). New talent joining would also view the company as unfavorable and refrain from applying because they would be under the impression that they would be let go first if market conditions are dire.

Other companies might also be faced with the dilemma of whether they should keep a senior employee with more experience earning higher wages, or more junior employees with less experience earning lower wages. In situations like this, it boils down to how much value an employee is able to provide. If a company has this knowledge-based criteria, experienced employees who understand the ins and outs of the business will be retained. If these key employees lose tenure, there might be difficulty onboarding new members when there is a gap in company knowledge. The team would not be able to function at the same velocity as before. Thus, compromising the performance of the company in the long run.

Alternatively, if a company is performance-based, they will retain high-performing teams or individuals and let go of those who are not producing an equivalent outcome. In situations like these, a person’s seniority in a company is not a key consideration. If a more senior employee who earns higher wages is of the same caliber as a junior employee earning lower wages, the company might lay off the former for practical budget reasons.

While the decisions never get easier, organizations must still execute this in a way they deem most effective. They must be clear of their goals and what they prioritize before making any decision. In the best-case scenario, employers have full transparency into employee productivity and efficiency to make justified decisions. However, this is often not the case. User and work data is hard to track in a company, and if it is monitored and taken to the extreme it can be an invasion of employee privacy.

Exhibit 3: Micro-level lay-off decision criterion

Removing individuals from certain roles without replacement would mean that those jobs require other ways to be executed. It is possible that during the restructuring another employee can double-up for roles. However, employees attention will be divided and significantly reduce their productivity. Over time, it might also lead to heightened job dissatisfaction due to increased exhaustion. Hence, most companies would rather automate these processes so that efficiency is not compromised. This can be done via engaging new software or programs.

Companies might employ these strategies to cushion the impact of a recession. High quality data should be used to inform these decisions. Ultimately, these decisions affect the livelihood of the company and its employees. Data-driven devisions are concrete, logical and not driven by intuition. Over time, it can realize cost savings and boost the confidence of the company. However, this relevant data might not be as easily acquired as one might think. It takes a lot of investment in time and manpower for companies to establish data owners and improve data maturity within the organization.

In order to make data driven decisions, the organization should first define their business objective. Then, they must obtain the relevant data and analyze it to draw conclusions. This can range from what is working for the company and what are the areas of improvement. For instance, if an organization is prioritizing reduction in costs, they must identify the avenues that are currently draining financial resources, then analyze which areas can be cut back on. This methodical step-by-step approach would be a company’s best bet in these situations.

So then, how are companies able to obtain the data they require in the context of reducing headcount during a recession? To understand the level of productivity of employees and how they manage their workflow, organizations must tap into communication channels to surface data. These channels contain ad-hoc back-and-forth communications about work to be done. Thus, data from this source can be leveraged on.

This is where TRIYO steps in. TRIYO embeds itself in widely-used communication channels like Outlook and MS Teams to capture latent data. These bits of information are stringed together in the audit trail to provide end-to-end transparency on business processes. From the time an email is opened to the time that the task is marked completed, employers are then be able to obtain a complete overview of the natural workflow of employees. Ultimately, decisions made within the company can leverage on the data collected to yield optimal results. Company executives are able to use this data as a focal point during the tough decision of headcount reduction.

TRIYO’s data intelligence engine aggregates information from all communication channels (emails, chats and videos) across an organization and extrapolates the data to generate powerful insights on resource utilization, client engagement and process efficiencies.

TRIYO’s recommendation engine computes the data gathered to surface live process discovery, suggest efficiencies and map processes.

Our mission is to help organizations surface and understand the latent data hidden in all communications channels to provide real-time insights into process gaps and to create efficiencies.