Simplifying The M&A Deal Process

Mergers and Acquisitions (M&A) refers to the consolidation of multiple business entities and assets through a series of financial transactions. This process includes all the steps involved in merging or acquiring a company, from start to finish.

M&A processes are very common when working in investment banking or corporate development. The M&A deal process has many steps and can often take anywhere from 6 months to several years to complete.

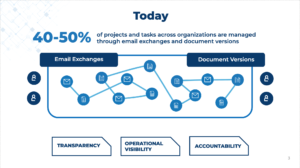

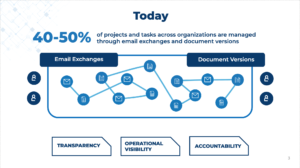

Generally, processes are organized and grouped by specific tasks, presentations or documents; so timely comments and approvals along the way are key. However, these generally slip through the cracks if the process is streamlined through email threads alone.

Collaboration for M&A processes require a lot of moving parts, as multiple teams are involved and most of the information is shared via email. That is why TRIYO can help simplify and streamline the M&A deal process.

With TRIYO’s innovative collaboration tool, users are able to create deal teams across diverse groups, and assign tasks and accountabilities to different members of the team.

Users will have the capability to take full control within approval tracking and see a clear audit trail of changes. Teams will be able to track and respond to tasks through their native email platform, allowing users to continue to work with their existing tools that they are accustomed to.

With TRIYO, you can now simplify the M&A process by allowing teams to undertake actions in parallel for deal decks, information memorandums, process letters, credit approvals, marketing materials, term-sheets, etc. Users have the ability to assign, parse, review, edit, and approve all from within the source document itself, eliminating the challenges that using email threads alone bring with it.

To learn more about how TRIYO can simplify your organization’s M&A deal process, click

here.